Fund the Future. Reap the Rewards

At Goodknight, we provide expert guidance and hands-on support for property investors and landlords. Whether you’re looking to optimise your current portfolio, build a high-yielding HMO from scratch, or secure a profitable investment opportunity, our specialist services are designed to help you achieve your goals.

Consultation Services

Our consultation services are tailored to your unique needs, whether you’re refining an existing strategy or exploring a new investment approach. We provide expert insights into:

- Market Supply & Demand – Understanding local trends and rental demand.

- Planning & Licensing – Ensuring compliance with local authority regulations.

- Fire Safety & Compliance – Meeting legal requirements to protect your tenants and investment.

- Target Demographics & Area Analysis – Identifying the most suitable tenants and locations.

- Income & Expenses – Assessing current vs. potential rental yields and operating costs.

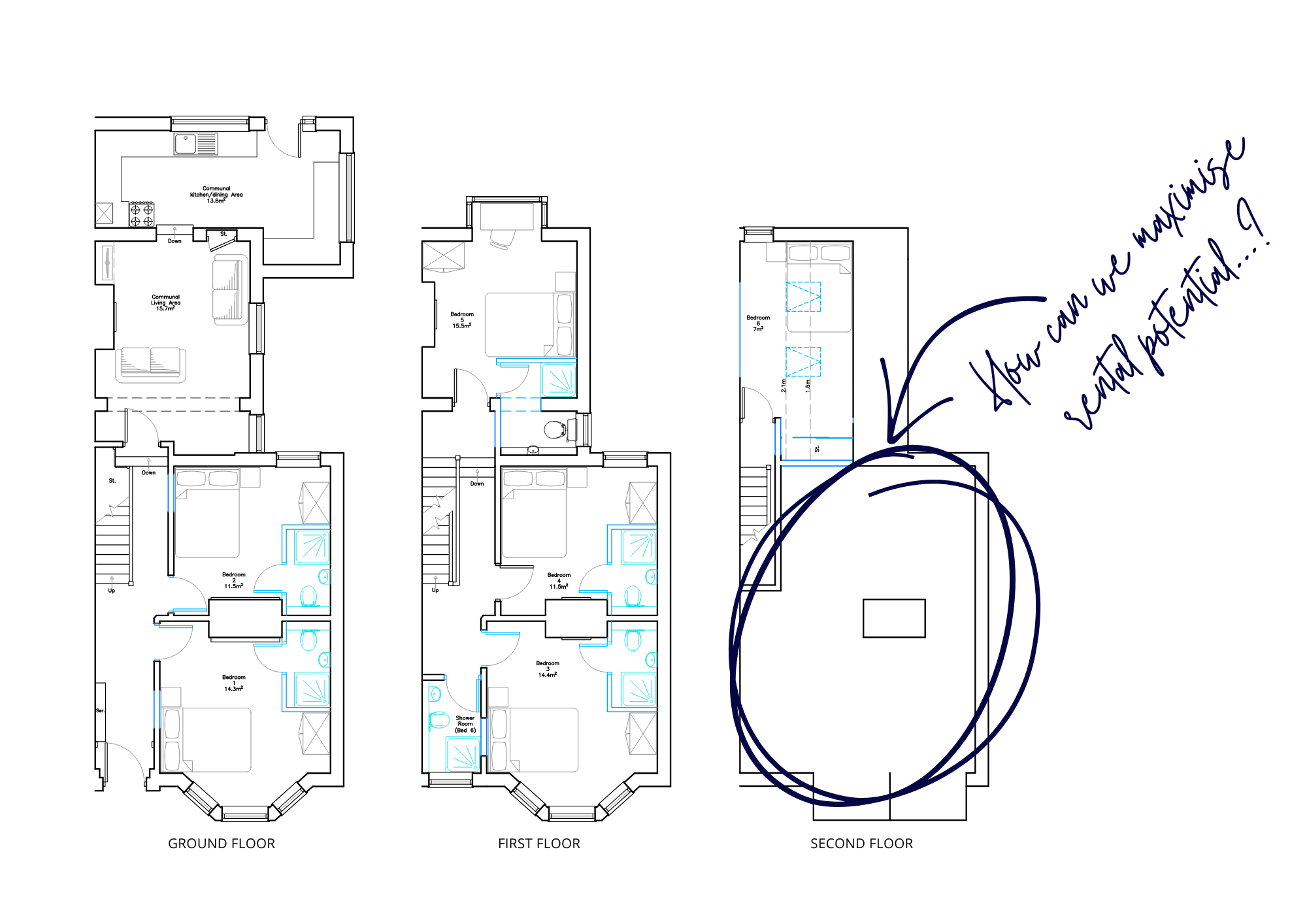

- Refurbishment & Cost Savings – Maximising property value while keeping costs under control.

- Profitability & Investment Strategy – Helping you optimise returns with expert guidance.

We offer an initial one-hour consultation to explore your needs and opportunities. Additional consultancy is available at £120 per hour.

Turn-Key HMO Build Service

Transforming a standard property into a compliant, high-performing HMO can be complex—but we make the process seamless. Our turn-key HMO build service covers:

- Property Sourcing & Feasibility Assessment – Finding the right property with strong yield potential.

- Planning & Licensing Applications – Navigating the approval process for hassle-free compliance.

- Design & Full Refurbishment Management – Creating stylish, functional co-living spaces.

- Regulatory Compliance & Certification – Ensuring fire safety, HMO licensing, and health and amenity standards.

- Tenant Attraction & Property Management – Setting up your HMO for long-term success.

From concept to completion, we take care of every step—allowing you to enjoy a hands-off, profitable investment.

Investor Services

Exclusive Opportunities for Serious Investors

At Goodknight, we partner with a select group of investors to fund highly profitable HMO developments, offering excellent returns with minimal hassle. Our track record speaks for itself—but we don’t accept investment from just anyone.

We carefully choose our investors, ensuring we work only with those who align with our strategic approach to property development. If selected, you’ll gain access to exclusive, asset-backed investment opportunities, allowing you to grow your wealth securely and passively.

Why Partner with Us?

- Proven Returns – Our investors earn high fixed returns over an agreed term.

- Asset-Backed Security – Your capital is secured against high-yield property assets.

- Tailored Risk Management – We responsibly manage funds in line with your individual risk appetite, ensuring an investment approach that aligns with your financial goals.

- Exclusive Access – We limit our investor partnerships to those who share our vision for long-term, sustainable success.

- Hands-Free Investment – We handle everything from acquisition to full tenancy, so you can enjoy passive income.

How It Works

- Apply to Invest – We carefully assess each investor to ensure the right fit.

- Capital Deployment – Your funds (£50k +) are allocated to a hand-picked, high-yield development project, tailored to your risk preferences.

- Growth & Returns – We develop the property, fully tenant it, and deliver your agreed returns.

INVEST SMART. EARN MORE. LET PROPERTY WORK FOR YOU.

We don’t just take on capital—we build lasting, profitable partnerships. If you’re ready to explore an exclusive investment opportunity, get in touch today to start the conversation.

Why we’re focused on Co-living HMOs…

We specialise in co-living HMO investments because they offer higher and more consistent rental yields compared to standard buy-to-lets, while addressing the growing demand for affordable, high-quality shared housing.

Here’s why co-living HMOs are a strong investment choice:

- Higher Rental Yields – HMOs typically generate 8-13% yields, outperforming traditional rentals.

- Reduced Void Periods – Multiple tenants mean consistent cash flow, even if one room is vacant.

- Increasing Tenant Demand – Rising property prices and a shortage of quality rental accommodation make co-living an attractive option for young professionals.

- Risk Diversification – Income is spread across multiple tenants rather than relying on a single renter.

- Maximised Property Value – Converting properties into high-end, fully compliant HMOs can significantly increase capital value, especially in Article 4 areas.

- Sustainable Long-Term Strategy – The co-living model aligns with urbanisation trends, shifting lifestyle preferences, and government incentives for high-density housing solutions.

By specialising in co-living HMOs, Goodknight ensures investors benefit from a proven, scalable, and resilient property strategy that delivers strong returns with professional management.